Learn How An Award-Winning Sage 100 Partner Can Transform Your Business

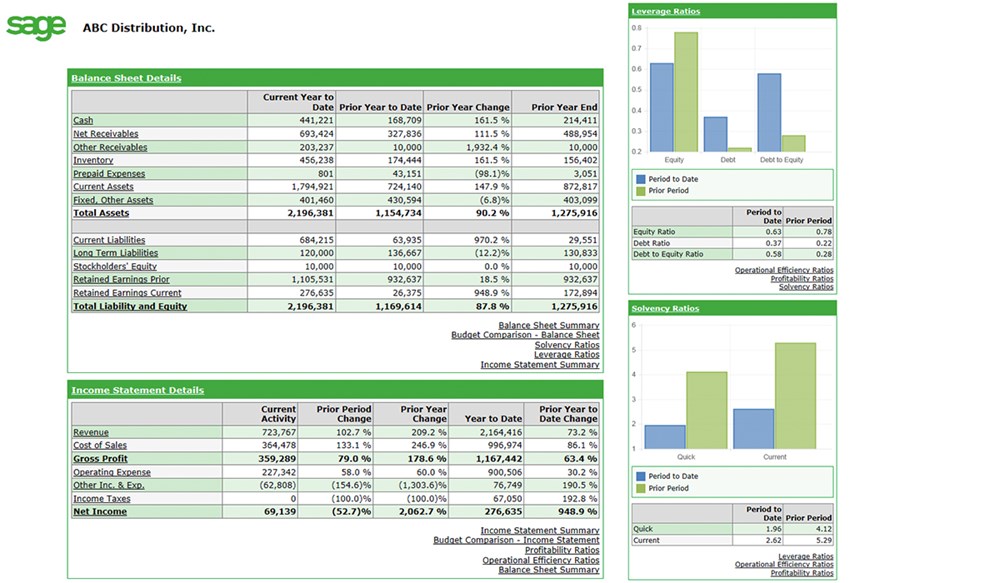

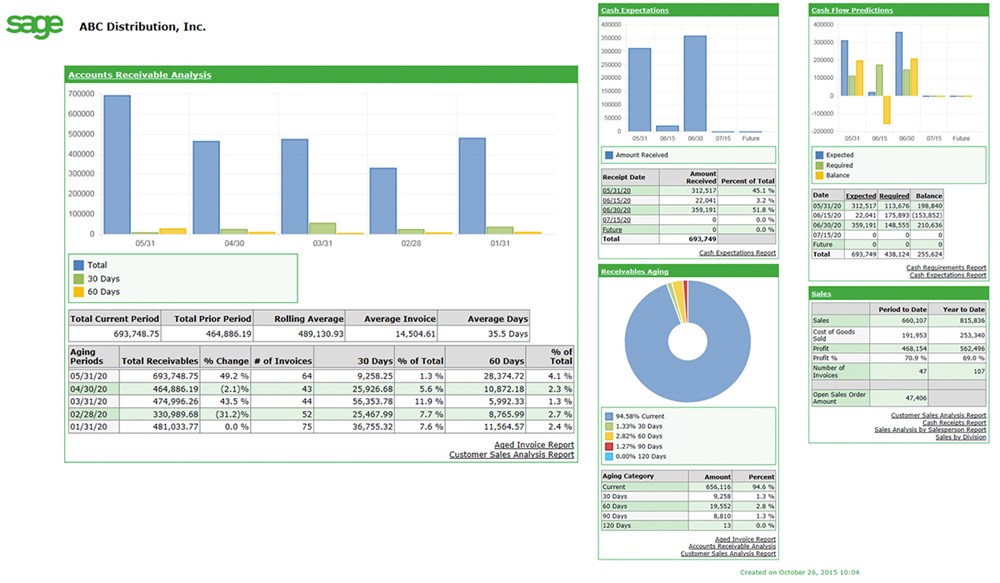

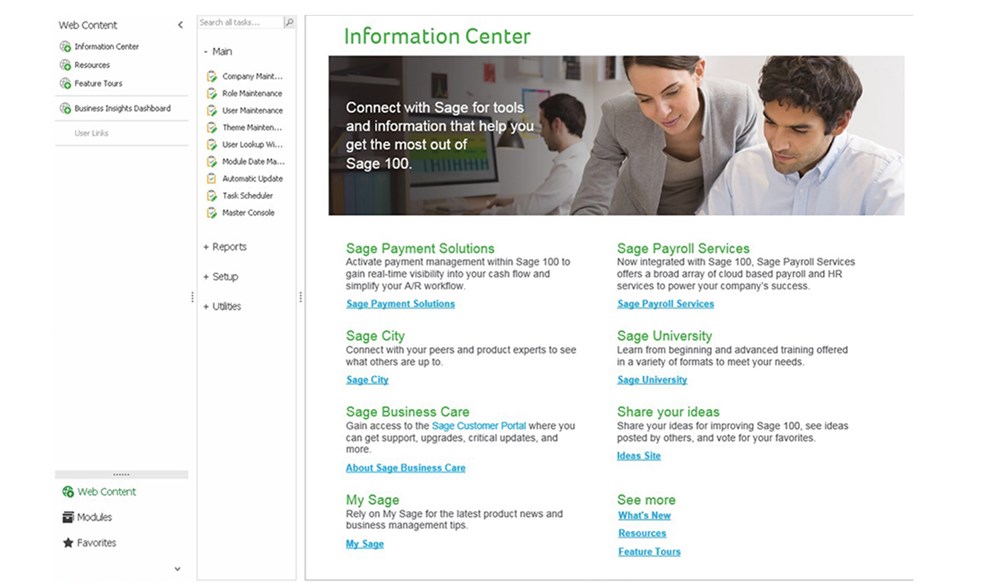

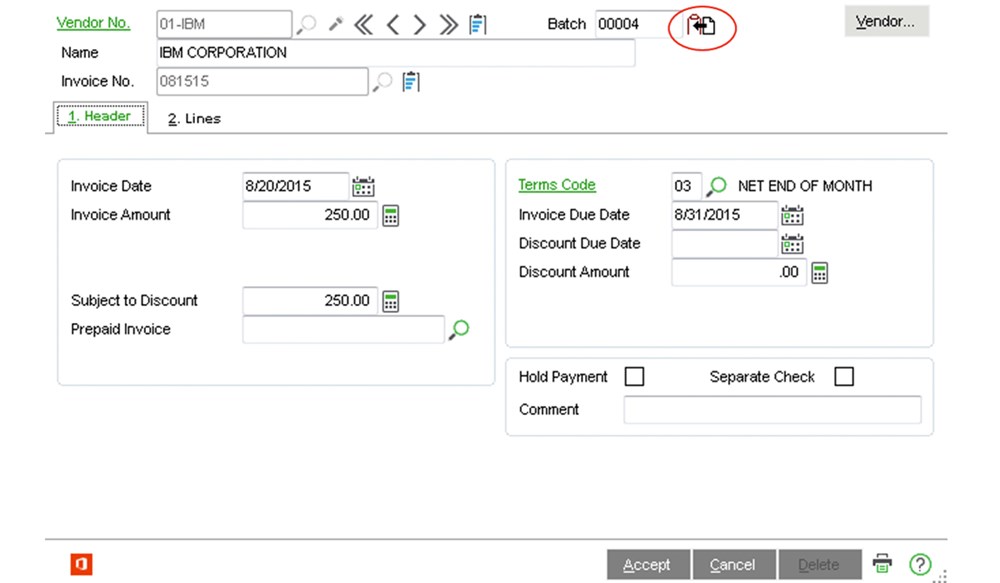

Sage 100 cloud (previously known as MAS 90 and MAS 200) gives you the power to manage your day-to-day operations. Let Blytheco show you how.

Blytheco is the longest tenured Sage 100 partner with over 40 years experience. Our expert team has partnered with customers across a range of industries and solution needs. We are recognized as a Sage Platinum Elite and Diamond level partner, the highest distinctions available. You can put your trust in Blytheco for all your Sage 100 support needs.

Blytheco’s team of Sage 100 experts are ready to safely upgrade your Sage 100 system.

Sage recently announced the depreciation of older Microsoft technologies utilized in older Sage 100 versions. Failure to upgrade older Sage versions exposes customers to material security risks as well as significant system disruption. Learn more here:

Evaluating Sage 100? Let Blytheco navigate solutions to see if Sage 100 is right for your business. For over 40 years, Blytheco has been the transformation partner of choice, providing software solutions, expertise, implementation services, education, and support to over 5,000 clients nationwide.

Wondering if you are using Sage 100 to the fullest? Put our expertise to work through our software optimization process and get the most out of your Sage 100 system. We can evaluate your business processes and help identify pain points, offering optimized solutions to maximize efficiencies and enable your business goals.

- Operations Management is a solution for make-to-order manufacturers.

-

This along with Production Management replaces Work Order and MRP. - Sage 100 Work Order and MRP modules will no longer supported by Sage in version 2023.

- Sage has replaced the legacy Work Order module with Production Management or Operations Management.

- Blytheco’s expert consultants can provide guidance in the selection of your go-forward manufacturing solution. - Track labor, BOM, Routings, and contracted services for a detailed cost rollup.

- Estimating and Quoting – Includes the ability to re-use past quotes.

- Purchasing, including consolidated purchase requirements and the ability to automatically generate Pos.

- Optional Add-ons: Configuration and Enhanced Scheduling.

Learn more HERE

- Production Management is an ideal solution for discrete manufacturers and distributors.

-

This along with Operations Management replaces Work Order and MRP. - Sage 100 Work Order and MRP modules will no longer supported by Sage in version 2023.

- Sage has replaced the legacy Work Order module with Production Management or Operations Management.

- Blytheco’s expert consultants can provide guidance in the selection of your go-forward manufacturing solution. - Production management enables subassembly manufacturing into a single work ticket where a parent item is being made.

- Make-to-Stock manufacturers will benefit from centralized data and the ability to manage and track the entire job lifecycle.

Learn more HERE

Talk to a Sage 100 Expert Today

Let our expert Sage 100 team show how you can leverage the features and functionality of Sage 100 most relevant to your needs, challenges, and requirements to get the most out of your solution.

Wondering if Sage 100 is a Good Fit for Your Business? Using Sage 100 and Seeking a Trusted Partner?

Whether you are exploring Sage 100, looking for Sage 100 support or seeking a Sage 100 upgrade, let Blytheco’s team of experts help you optimize Sage 100.

Your Access to Sage 100 Resources

Check Out Our Blytheco Sage 100 Resources for Helpful Information

Sage 100 (MAS 90) Training

Explore our full library of on-demand Sage 100 (MAS 90) training videos. Our comprehensive educational videos will help you and your team master your Sage 100 software and answer questions that may arise, so you can utilize your Sage 100 solution to its fullest potential.

WHEREVER YOU ARE IN YOUR SAGE 100 SOFTWARE JOURNEY, WE CAN HELP