Processing supplier invoices demands precision and timeliness. Explore firsthand how Acumatica's groundbreaking 3-way match functionality addresses these challenges head-on. See how this feature automates reconciliation, minimizes errors, and boosts efficiency throughout your organization.

Acumatica significantly reduces the cost of entering AP bills with the document recognition feature. This tool allows you to import a PDF file from a vendor and translate that into an AP bill, minimizing data entry.

Requisition management software simplifies the process of purchasing various products from diverse suppliers. Instead of relying on emails and spreadsheets, this software automates request gathering, vendor bidding, quote creation, approval, purchase management, and order fulfillment in one centralized platform.

Enterprise Resource Planning (ERP) implementation projects evoke a mix of excitement and apprehension. The promised benefits can profoundly impact your business. Leveraging over four decades of experience bringing ERP to thousands of businesses, Blytheco has curated this interactive guide to navigate you through the top 6 crucial planning stages, and subsequent phases, of a new software implementation.

In today's ever-changing landscape, software solutions are consistently advancing and extending their capabilities to cater to the growing requirements of businesses like yours.

Transforming your business is no easy feat. Today’s software solutions are constantly evolving and expanding their capabilities to accommodate the growing needs of businesses like yours—but where do you start?

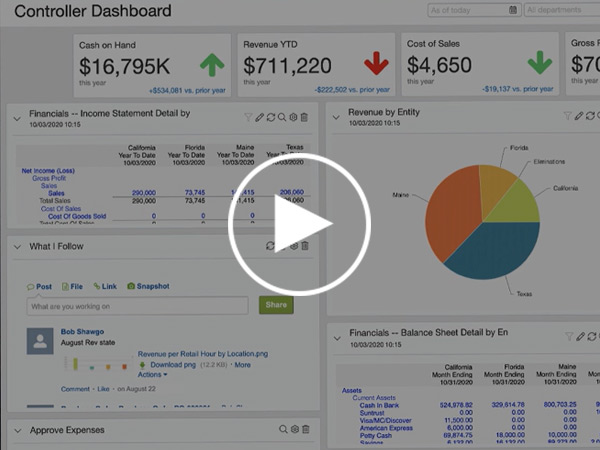

Learn about Sage Intacct data visibility, KPIs and dashboards from Blytheco’s Craig Silvestri, Director of Cloud Growth.

Learn about Sage Intacct automation from Blytheco’s Craig Silvestri, Director of Cloud Growth.

Learn about Sage Intacct multi-entity functionality from Blytheco’s Craig Silvestri, Director of Cloud Growth.

This video (on-demand webinar) offers a detailed look at how Sage Intacct compares to Sage 100.

Sage Intacct provides real-time reports, dashboards and visualizations. This can save you hours per month and improve data accuracy.

Fast-moving enterprises understand the importance of timely information to compete successfully in a connected world. They recognize the risks of delay and the rapid advantages a cloud financial system brings their business. There are seven reasons now is the time to move to cloud financials.

Watch this presentation and demo on how Sage Intacct dashboards can provide increasing visibility and insights on-demand, with current information in a single view. By providing meaningful metrics, with role-based dashboards, you can see information specific to your job at your fingertips. See what other customers are doing with dashboards and how simple it is for any user to build a dashboard using Intacct.

Watch this brief demo of how Sage Intacct core financials saves time and enables better decision making for accounting teams. See how accounts payable, accounts receivable, cash management and general ledger functions with with upstream and downstream processes through automation, resulting in greater productivity and better decision making.

The cloud offers compelling and unmatched advantages for deploying business software, and particularly financial applications. This paper will help you understand the key questions to ask before considering a move to a cloud-based financial solution and how to be an informed buyer. You'll learn the key decisions to make early on, why the process for evaluating software is different for cloud solutions and best practices for choosing a partner.

To help keep your Sage 100 environment secure, Basic Authentication (Username and password) is being replaced by a more robust modern authentication method. We strongly recommend that all Sage 100 users leverage these new methods, in conjunction with Multi-Factor Authentication for all users to reduce the likelihood of intrusion. To help simplify this process, our Sage consultants have prepared a step-by-step educational guide to walk you through the configuration of Modern Authentication (OAuth) for Azure/O365.

The business world is constantly evolving. Businesses and their software need to be able to keep up with changing industry requirements and changes in the business as they grow. Outdated technology is one way to fall behind, lose money, increase risk, and waste time. Download this upgrade checklist to determine if your business needs a software upgrade or replacement.

Watch the George T. Hall customer success video to see how they benefitted from moving to a modern cloud ERP system with a fully integrated single platform and gained reliable data and insights with Acumatica.

Discover how your business can leverage digitalization to challenge the status quo and establish market leadership in this eBook from Sage Intacct and Blytheco.

Learn about unlocking value in the cloud for your business with Sage Intacct in the voice of former Sage 100, Sage 300, and Sage 500 customers in this informative eBook.

Today having a clear picture of your business’s situation is critical with the constant change driven by disruption and market volatility. Here are three reasons why you need to make your planning more dynamic now.

Learn about key findings from the 2021 Close the Books Survey to help you benchmark against your peers and learn the best practices of leading-edge organizations.

Change is a permanent feature of our modern world, and as technology advances, change happens at an increasingly rapid pace. That’s why every company—especially growing companies—needs to be ready to accommodate whatever the future brings, and that means having the flexibility to change course quickly and effectively in response to unforeseen circumstances and new opportunities. Learn effective strategies to set your business up for success with an adaptable, scalable, agile, cloud-based ERP infrastructure with this free eBook.

"There's only one way to grow our margins, and that's to be more efficient," Smith says.

AFF has been able to do both since implementing Acumatica. With Blytheco’s expert assistance, they implemented Acumatica Customer Management, Acumatica Manufacturing Edition with Financial Management, Order Management, Inventory Control, and BOM, MRP, and Production Management.

The past year greatly emphasized the importance that every business must be a digital business. Companies faced immense pressure to create new value in customer experiences and their day-to-day operations. Digital-only brands already had a leg up on traditional players, but finding themselves falling behind, the traditional companies began transforming their business models with digital technologies.

Cloud software offers modern businesses a competitive edge and positively changes day-to-day operations to boost efficiency, automate redundant tasks, and increase collaboration. With over 40 years of expertise and 5,000 successful implementations, Blytheco has learned a few tips to accelerate business growth.

Now more than ever, businesses have realized that change is a constant and adopting new perspectives and tools can be crucial to growing your business in any environment. This can be a determining factor in running a profitable and efficient business. After 5,000 successful implementations, Blytheco has learned a few tips to increasing profitability. In this eBook we'll explore:

CRM is not just for B2C organizations and some CRM functionality extends way above and beyond your marketing team. Learn how modern manufacturers and distributors are unlocking new sales potential and growing profits by putting their customers at the heart of their processes.

The world has been drastically impacted by the global recent events. Many businesses have adapted to the new reality of managing a remote workforce, while many consumers have shifted behaviors to accommodate new operational guidelines. This eBook provides an in-depth look at 6 compelling business trends that can accelerate business growth and give your company a competitive advantage in the years to come! Explore:

A properly executed software implementation can positively impact your business, help you meet your company growth targets, and help you avoid costly mistakes. Explore this checklist to ensure you have a successful implementation.

Bob Scott, an expert in the financial software community, compiles a list each year of 100 VARs that are proving to be exceptional leaders in the field. Blytheco is proud to be represented yet again this year. Check out the entire article and learn more about the selection process.

Using accounting software to manage inventory and stock will inevitably lead to problems. Yet, many growing wholesalers and distributors still rely on manual processes long after outgrowing their usefulness. This eBook shows how wholesale and distribution can benefit from the right ERP.

As companies grow, their needs and software requirements grow along with them. Unfortunately, not all software can accommodate this growth. This checklist can help you determine if you are using the right software for your business.

It is one of the biggest nightmares for food and beverage manufacturers to have products contaminated by an unknown source. Traceability allows businesses to verify the history and location of a product through documented, recorded verification, and it helps manufacturers significantly improve their operations. There are new and emerging software solutions which allow food and beverage manufacturers to log transactional and product data. This guide shows you how the right ERP can improve traceability.

A recall is the single biggest threat you can face as a food and beverage manufacturer. In the last 10 years, the number of recalls has increased by over 50%. Having the ability to detect food contamination, report ingredients, and declare allergens in food is critical to surviving a recall and ensuring profitability. An ERP provides essential capabilities that allow leading food and beverage manufacturers to deal with everchanging regulatory expectations. Explore the benefits of modern ERP software designed for food and beverage manufacturers in this guide, and learn how it can change your business.

There’s so many choices that come to mind when you are trying to select a new ERP solution for your company. One of the first decisions you’ll have to make is: should you pick cloud based, or on-premise? This is a crucial decision, as your ERP is something you and your employees will be using daily. There are advantages and disadvantages to both solutions. Check out this comparison that covers the ins and outs of both options to help you make the best choice.

As the modern workplace evolves and work-from-home flexibility becomes a requirement, we have to rethink the tools in place to support our remote teams. In this webinar, our team explores 4 new tools for Sage 100 that can help optimize your workflows and create a streamlined remote environment. Learn more about:

Looking to move your on-premise Sage 100 business to the cloud? This on-demand webinar features a blyCloud tutorial and step-by-step instructions for taking your business to the cloud. Learn all you need to know about your hosting options and how you can eliminate costly, time-consuming server maintenance and gain unparalleled security, continuous system backups, and a reliable network.

When it comes to ERP software, finding the right partner for your business needs is critical. Today's businesses have hundreds of software offerings to choose from as well as hundreds of reseller partners, and publishers for the same software.

While this is an advantage to the customer, it can often make the evaluation and selection process overwhelming. In this helpful guide, we compare publisher and reseller implementation factors such as:

As Sage continues to evolve and expand the functional capabilities of Sage 100, we developed this guide to help you and your team navigate these changes, explore new solutions, and get the most out of your software investment. In this guide, we explore:

White Oak Pastures is a farming and meat processing facility located in Bluffton, GA. For years, White Oak experienced growing pains and challenges managing their business on multiple disparate systems.

Acumatica ERP offers adaptable and scalable cloud and mobile technology, enabling a complete, real-time view of your business anytime, anywhere. This recorded product tour helps you explore the features, functionality, and benefits of Acumatica. In this demo, we explore:

Sage 100cloud is one of the most trusted on-premise ERP solutions available to small- to mid-market businesses. This recorded product tour helps you explore the features, functionality, and benefits of Sage 100cloud (formerly MAS 90/Sage 100).

Nexus, tax tiers, compliance, use tax, tax obligations, exemption certificates, and audits—each of these have separate regulations. Most companies are unsure of how to navigate the constantly changing regulations imposed on them when it comes to managing all things taxes.

As the company experienced significant growth, Blytheco was able to help Bestbath begin their software transformation to replace their existing ERP. Find out how they streamlined their manufacturing processes, gained companywide visibility, and found a solution that is scalable as their business grows.

From solution evaluation to go-live and beyond, Blytheco client Kobayashi reveals the details of their business transformation. Learn how the number one manufacturer and supplier of air-activated heat warmers optimized, automated, and consolidated their business processes onto one software platform.

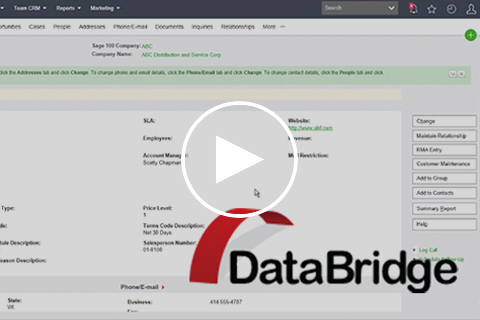

Blytheco's DataBridge is a Sage 100 to Sage CRM Data Connector. DataBridge enables a Sage CRM web user to access on-premise Sage 100 data from any location. Access Sage 100 data in real-time through a robust framework of pre-built dashboards, screens, tabs, and reports.

For the last 40 years, Sage 100 has been a trusted platform for thousands of businesses around the world. Over the years, Sage has introduced major product revisions to evolve with changing technology, changing business landscapes, and the growing needs of their customer base.

Since every business is unique, it can be challenging to determine which Enterprise Resource Planning (ERP) software is right for you. To help you determine which option makes the most sense for your company, we’re offering a detailed side-by-side comparison.

In order to stay competitive, your Enterprise Resource Planning software needs to continuously evolve just as your business keeps enhancing and growing.

Managing every aspect of your business can be daunting if you do not have the right ERP system and partnership in place.

While most Enterprise Resource Planning platforms have the same core capabilities, each one has its own strengths and differences in functionality. This knowledge could be the reason between picking the best ERP system for your organization or picking the wrong one.

Stuck deciding which Enterprise Resource Planning software is best for your organization? It’s a more common question than you think. There are a multitude of system options and a vast array of similar features out in the marketplace. Blytheco compares Sage100 and Acumatica to get you the answers.

Workarounds and manual processes were painful, time-consuming, and insufficient to meet the needs of their growing business. Discover more about HGC transitioning to Sage X3 and drastically increasing productivity.

Acumatica delivers the benefits that today's businesses require in a Modern ERP - adaptable cloud and mobile technology - with a unique all-inclusive user licensing model, enabling a complete, real-time view of your business anytime, anywhere.

Our team has proudly helped thousands of clients solve their business challenges and grow their business. By leveraging our proven process, creative solutions, and 40 years of expertise, we are able to guide your business to success regardless of where you are in your software journey.

What started out as the hunt for a new accounting system turned into an overall operations and inventory management assessment. Learn how GWY recognized the need for a single system to handle all the complexities of their niche rental, service, and inventory business.

This video series offers you a detailed look into the built-in distribution functionality for Sage 100 (previously Sage 100/MAS 90).

Over the next 10 years, technology will do more to change the finance and accounting organization than it has over the past 50. Advances in databases, data processing, analytics and tools addressing the user experience as well as the application of artificial intelligence will free up much of the time now required by unproductive manual processes. Learn more about the five areas most finance executives will need to address to realize this transformation.

SAGE 100 (MAS 90) TRAINING CENTER

Explore over 100 free on-demand Sage 100 (MAS 90) training videos. These education videos offer tips, tricks, and training to help your team get the most out of your Sage 100 investment.